Hey pStake! Curtis here from the Balancer Labs partnerships team. We’ve been closely monitoring your protocol (and liquid staked assets at large) for the last few months and are big fans of what you’re doing.

First of all, I’m very happy to see another competent liquid staked asset protocol like yourselves on the market. Second of all, I do wholeheartedly agree with at least a starting round of LM in order to draw additional eyes to the protocol as well as establish sufficient on-chain liquidity. However I’m not sure that deploying to a typical 50/50 pool, as has been popularized in DeFi, is the best option for pStake.

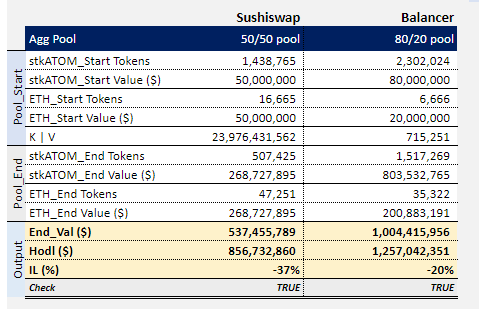

Balancer’s 80/20 weighted pools offer greater Impermanent Loss protection preserve significant upside when compared to it’s 50/50 counterparts and allows for sufficient price depth based on stkATOM’s average volume.

Also due to the recent release of veBAL, pStake provisioned Liquidity Mining may also be able to taper off due to the additional incentives provided by veBAL gauge voting.

What I propose is to launch an 80/20 weighted pool on Balancer (80% stkATOM/20% ETH) and to direct the appropriate incentives there. What this will do is preserve upside for stkATOM holders (see below analysis), protect holders from Impermanent Loss and allow for a more sustainable liquidity future for pStake.

Also worth noting, Balancer provides Dynamic Swap Fees based on Market conditions (which routinely have shown to provide greater revenue for LPers as opposed to any static swap fee) and The Vault to allow for more gas efficient swaps

Also here is an analysis I ran showing if the stkATOM/ETH LP had been deployed on Balancer as an 80/20 pool, as opposed to the 50/50 pool deployed on Sushiswap - here.